On Monday evening, 9 April 2018, the government announced significant changes to Iran’s foreign exchange regime, with immediate effect. These changes are designed to centralise foreign currency exchange within the banking system and enhance monitoring and control of the exchange market by the Central Bank of Iran (CBI). In particular, the changes:

•eliminate the dual exchange rate system in favor of a managed float at a single rate set by CBI, initially at IRR42,000 per USD;

•centralise the purchase of foreign currency for import purposes and the sale of foreign currency export earnings, on a single new CBI platform;

•limit physical foreign currency holdings; and

•criminalise foreign currency transactions other than through permitted channels.

The timing of the changes was driven by significant recent FX market volatility, although the government has been moving in this direction for some time. Prior to the announcement, the preferential “official” exchange rate had been around IRR38,000 per USD, while the open market rate had diverged appreciably and rapidly to exceed IRR60,000 per USD.

The changes will have significant implications for foreign currency-denominated business with Iran, but the full implications will only become clear once various implementing regulations and directives are promulgated and then tested in practice. The purpose of this note is to communicate what is now known, explain the context of the change and identify important unknowns and what to expect.

The changes taken together represent a new model for the exchange rate regime – one intended to immunise the economy somewhat from the effect of adverse non-economic factors. It is centralised and gives CBI significant visibility into the market. It is also bank-centered, while preserving a role for the exchange bureaus which have in the past proven useful given the limited number of correspondent banking relationships, and may again become indispensable. It includes a long-discussed unified exchange rate, introduced earlier than expected, but that rate is unified at a CBI-set managed floating rate rather than an open market one.

Background

Except for a period in 2012-13, Iran has had a dual exchange rate regime for some time, whereby a preferential “official” rate (the Official Rate) applied for specified priorities set (and varied) by CBI (e.g., import of medicines and foods) to provide an implicit subsidy, while for other uses foreign currency was available at the open market rate (Open Market Rate). The Official Rate tended to depreciate in a crawl and usually provided a 10% to 20% preference compared to the Open Market Rate. During a period in 2012-13, an intermediate third rate falling between the other two (called the “Trading Rate”) was introduced for specific imports which enjoyed some priority but not the highest priority. The limitations of multiple exchange rates have been recognised and the authorities have publicly sought for some time to move to a unified exchange rate regime, in line with IMF recommendations, when circumstances would permit this to be done prudently.

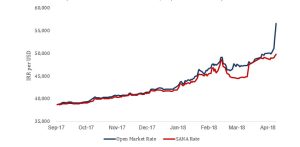

The days and weeks leading up to Monday’s change had witnessed a sharp decline of the Iranian rial, accelerating a trend that began in late 2017. During 2017, the IRR-USD Open Market Rate had stayed within a narrow band between IRR38,000 and IRR40,000 until November, at which point the rial began to depreciate sharply. The following chart shows the IRR-USD Open Market Rate since September 2017.

Open Market Rate and SANA Rate, September 2017 – April 2018

Sources: TGJU.ir and sanarate.ir

The chart also depicts CBI’s SANA rate (SANA Rate), a rate published on www.sanarate.ir and purporting to be, as the average of transacted rates at selected licensed exchange bureaus, an official index of the Open Market Rate. As the chart shows, the SANA Rate had mirrored the Open Market Rate until December, and then began to diverge, sometimes significantly, indicating the stress in the FX market. At times in recent weeks, licensed exchange bureaus were unwilling or unable to sell foreign currency at anywhere near the SANA Rate.

Press reports and government statements have attributed the recent stresses in the FX market to non-economic factors, on the basis that economic fundamentals such as inflation, reserves and balance of payments were healthy and did not justify the devaluation observed. The non-economic factors pointed to included political uncertainties, speculation and more limited access to physical foreign currency.

Recent foreign-currency related regulatory initiatives

In the last 18 months, CBI and other government agencies have undertaken a number of initiatives designed to increase the government’s view into and control of the FX market, and to steer FX transactions to the banking sector. These initiatives, which paved the way for the recently announced changes, included:

•requiring registration of imports of foreign currency bills in excess of €10,000 (or equivalent) per person, and limiting export of foreign currency bills to €10,000 (or equivalent) per person (unless the person is exporting bills previously imported and declared);

•requiring reporting of domestic foreign currency transactions within the banking system;

•seeking to shut down unlicensed exchange bureaus;

•introducing a new CBI platform for foreign currency transactions (called “NIMA”) and requiring all banks and exchanges bureaus to register their transactions on it;

•seeking to force importers to obtain and present invoices in currencies other than USD for registration of their import orders, consistent with a government policy to reduce demand for USD and eliminate its use in transactions; and

•requiring payment for registered imports from China, South Korea, India and Turkey to be made via banking channels only.

What is known

Monday’s decision was taken in the name of the Economic Committee of the Government, an ad hoc executive-branch body including representatives of CBI, the Ministry of Economic Affairs and Finance, and the Management and Planning Organisation (which controls the government budget). Implementation falls primarily to CBI.

What is so far known is based on: a statement by the First Vice-President following the emergency meeting of this Committee on Monday evening; three subsequent announcements on the CBI website (termed ‘Announcements on the Unification of the Exchange Rate’); and parliamentary testimony and an extended press interview by the CBI Governor on Tuesday. In summary:

1.Effective 10 April 2018, CBI will supply foreign currency for “all lawful commercial and production-related needs, subject to import, export and foreign currency laws of the country, on the basis of IRR42,000 per USD”. This initial rate was later clarified to be subject to a managed float, and anticipated, according to the CBI Governor, to vary up to “6 to 7 percent” per year.

2.The exchange rate for IRR against other currencies will apparently be set in line with how the other currencies trade against USD internationally.

3.Foreign currency needed to pay for imports will be supplied only after registration of the import order (with the Trade Promotion Organisation, an affiliate of the Ministry of Industry, Mines and Trade). Orders will only be accepted for registration if the mode of payment is through the banking system.

4.Non-oil exporters (which includes petrochemicals) must sell to banks or licensed exchange bureaus, through the NIMA platform mentioned above, all their foreign currency receipts from exports, other than those they (i) use to import goods and services for themselves, (ii) use to repay foreign currency debt, or (iii) deposit in banks.

5.After completing the required procedures for payment for imports, banks may perform the payment themselves, register a foreign currency remittance request through the NIMA platform or make a payment through licensed exchange bureaus.

6.The maximum amount of physical foreign currency a person may hold is €10,000 (or equivalent). By 20 April 2018, any amount in excess of this must either be sold to a bank or deposited into a foreign currency account at a bank. Such deposits will earn interest at the CBI-authorised rate and withdrawal in the original foreign currency is assured.

7.Any sale or purchase of foreign currency outside the banking system or licensed exchange bureaus is deemed to be a criminal act and punishable accordingly . Therefore, CBI, banks and licensed exchange bureaus are the sole sources from which foreign currency may be purchased.

8.Repatriation of investments and profits protected by the Foreign Investment Promotion and Protection Act 2002 (FIPPA) will take place at the new uniform exchange rate, according to the text of FIPPA and as confirmed by the First Vice-President in press reports. Under Article 12 of FIPPA, for investment-related conversion into IRR (where capital is brought in) or for investment-related conversion from IRR (when capital or profits are repatriated), the exchange rate determined by CBI will apply, unless there is a uniform exchange rate for the relevant foreign currency in which case the uniform rate will apply. Accordingly, the new uniform exchange rate should apply. This is consistent with CBI’s December 2017 directive in which banks were directed to use the open market exchange rate for sale of foreign currency for purposes of repatriation of the principal or profit of foreign investments.

9.CBI made two announcements on Tuesday and early Wednesday aimed at the general population, addressing foreign currency needs of passengers (a maximum of €1,000 per person per year can be purchased from a bank branch at the airport on the way out), medical patients and students.

What is unknown

There remain some areas of uncertainty

1.It has not been explained what formula or approach will be used in varying the new uniform rate over time. Nor has the rationale for the initial rate of IRR42,000 per USD been explained, which might give an indication of expected frequency and quantum of annual adjustment through the managed float.

2.The method of setting exchange rates other than IRR-USD is not explicitly specified. It is presumed that the exchange rate for other currencies will be set in line with how other currencies trade against USD internationally. The CBI website published exchange rates for EUR, GBP, SFR and JPY on 10 and 11 April 2018 which appeared to have been set with this logic, varying even as the IRR-USD rate remained unchanged.

3.It appears that foreign currency proceeds of all non-oil export earnings are apparently required to be sold through CBI’s NIMA platform, and all foreign currency required for imports is to be purchased there. How will imbalances be managed?

4.What will, in practice, be the procedures, necessary documents and evidence required to obtain foreign currency under the new regime? Will these create further de facto limits?

5.In practice, what new limitations will there be for foreign currency borrowings? Nothing specific has been promulgated so far.

6.What access will entities other than importers and borrowers have to foreign currency, for example for investment? Presumably there will be other limits, though they have not been specified.

7.Will hedging instruments based on the uniform rate be permitted? Or prevented in order to not have any alternative rate signal?

8.What will be the effect on existing foreign currency-denominated agreements and obligations?

9.Those government-linked entities entitled to obtain foreign currency at the preferential Official Rate developed their budgets for the just-started Iranian financial year based on an exchange rate of IRR35,000 per USD. Now facing a rate of IRR 42,000 or more, they could have foreign debt repayment problems later this year. What provisions will the government make to support them?

What is next

Given the pressing circumstances, there does not appear to have been in place a pre-planned regulatory or communication strategy, so various announcements, guidelines and directives from CBI can be expected in the near future. Other governmental entities will be looking for CBI’s guidance to communicate the position to their affected constituents.

While full details have been promised by Thursday (the first day of the Iranian weekend), whatever is announced is more likely to be aimed at satisfying information needs of the general population and smaller importers. The more complex rules and procedures relevant to foreign investors and major importation may take some time to be conceived and come into focus in practice. And it would not be surprising if the procedures as applied constrain what the rules as written offer.

It will take market visibility, regulatory wherewithal and management capacity for any regulator to successfully set up and administer an ambitious new FX regime. And then there are the economic management challenges that accompany fetters on capital flows. If a well-implemented regime attracts confidence and adheres, and its challenges are met, the resulting stability would, alongside the stable inflation rate already established, be a significant enhancement to the domestic business environment.

There will be a period of some uncertainty. We will prepare further updates as things develop. In the meantime, please feel free to contact us at the details below if we can assist.

The material in this alert constitutes only a general overview. It is not legal advice, must not be relied upon as such, and we disclaim any liability arising from such reliance. Readers are advised to obtain specific legal advice if the matters discussed herein are relevant to them.

Sabeti & Khatami is a legal practice offering foreign and domestic clients the highest quality advice and service on matters of Iranian law with an international element. The firm distinguishes itself through first-rate advice and effective solutions reflecting commercial awareness; an overriding client focus; and the highest professional standards. We understand well the perspectives and preferences of international clients. Our practice areas, guided by our specific strengths, are focused on corporate, finance and projects work with a cross-border element.

© Sabeti & Khatami 2019

Hooman Sabeti

Hooman Sabeti

Partner

hooman.sabeti@sabeti-khatami.com

Behnam Khatami

Behnam Khatami

Partner

behnam.khatami@sabeti-khatami.com

Amir Mirtaheri

Amir Mirtaheri

Associate

amir.mirtaheri@sabeti-khatami.com